All Categories

Featured

Table of Contents

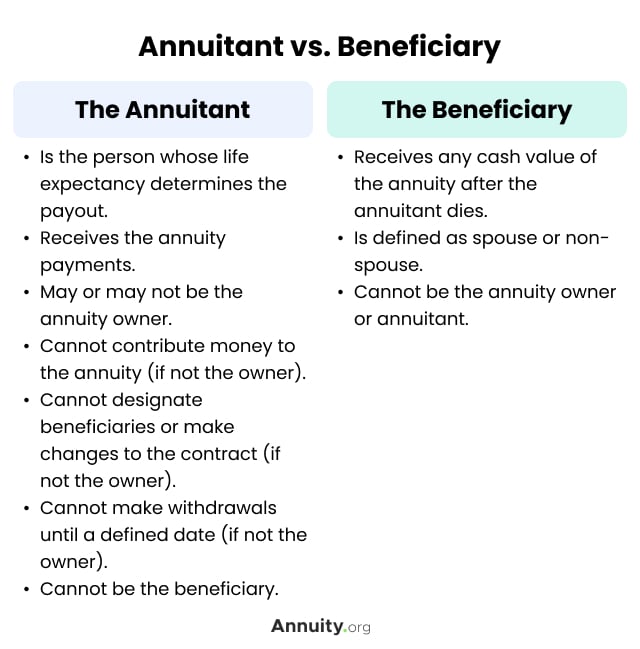

On the various other hand, if a customer requires to offer a special requirements kid that may not be able to handle their very own money, a trust can be included as a beneficiary, enabling the trustee to take care of the circulations. The kind of recipient an annuity owner picks influences what the recipient can do with their acquired annuity and exactly how the earnings will certainly be strained.

Numerous contracts allow a spouse to identify what to do with the annuity after the owner dies. A spouse can change the annuity contract right into their name, presuming all rules and civil liberties to the first contract and delaying immediate tax consequences (Annuity income). They can collect all staying repayments and any kind of death benefits and pick beneficiaries

When a spouse becomes the annuitant, the partner takes over the stream of settlements. Joint and survivor annuities additionally enable a called beneficiary to take over the contract in a stream of repayments, rather than a swelling sum.

A non-spouse can just access the marked funds from the annuity owner's first arrangement. Annuity owners can select to designate a trust fund as their recipient.

What is included in an Annuity Contracts contract?

These distinctions designate which recipient will get the entire fatality benefit. If the annuity owner or annuitant dies and the key recipient is still active, the primary beneficiary receives the survivor benefit. If the main beneficiary predeceases the annuity proprietor or annuitant, the fatality benefit will certainly go to the contingent annuitant when the owner or annuitant passes away.

The proprietor can change beneficiaries at any moment, as long as the agreement does not call for an unalterable beneficiary to be called. According to skilled contributor, Aamir M. Chalisa, "it is essential to understand the value of designating a beneficiary, as choosing the wrong beneficiary can have significant consequences. A number of our customers select to call their underage kids as beneficiaries, typically as the primary beneficiaries in the absence of a spouse.

Owners that are wed must not assume their annuity immediately passes to their partner. Commonly, they experience probate first. Our short quiz supplies clearness on whether an annuity is a clever choice for your retirement portfolio. When picking a recipient, consider factors such as your connection with the person, their age and just how inheriting your annuity could influence their financial scenario.

The recipient's connection to the annuitant normally figures out the policies they comply with. For instance, a spousal beneficiary has even more alternatives for taking care of an inherited annuity and is dealt with even more leniently with taxes than a non-spouse beneficiary, such as a child or other family member. Annuity accumulation phase. Mean the proprietor does make a decision to call a kid or grandchild as a beneficiary to their annuity

What is an Senior Annuities?

In estate preparation, a per stirpes designation specifies that, ought to your beneficiary pass away prior to you do, the beneficiary's offspring (kids, grandchildren, and so on) will certainly obtain the fatality advantage. Attach with an annuity specialist. After you've chosen and called your recipient or beneficiaries, you need to proceed to review your options at least yearly.

Maintaining your classifications up to date can make sure that your annuity will be managed according to your desires ought to you pass away all of a sudden. An annual review, significant life occasions can motivate annuity proprietors to take an additional appearance at their recipient choices.

What is included in an Annuities For Retirement Planning contract?

As with any type of financial item, looking for the help of a financial advisor can be advantageous. A monetary organizer can direct you with annuity monitoring procedures, including the approaches for updating your agreement's recipient. If no recipient is called, the payout of an annuity's fatality advantage mosts likely to the estate of the annuity owner.

To make Wealthtender cost-free for visitors, we generate income from marketers, consisting of monetary specialists and companies that pay to be featured. This produces a problem of interest when we favor their promo over others. Read our content plan and terms of solution to find out more. Wealthtender is not a customer of these economic providers.

As a writer, it's one of the finest compliments you can give me. And though I truly value any one of you investing several of your hectic days reading what I compose, clapping for my post, and/or leaving appreciation in a comment, asking me to cover a topic for you really makes my day.

It's you stating you trust me to cover a subject that is necessary for you, and that you're certain I 'd do so much better than what you can currently locate on the internet. Pretty stimulating stuff, and a duty I don't take likely. If I'm not knowledgeable about the subject, I research it online and/or with get in touches with who know more concerning it than I do.

Is there a budget-friendly Tax-deferred Annuities option?

In my friend's situation, she was thinking it would certainly be an insurance plan of types if she ever enters into nursing home treatment. Can you cover annuities in a post?" Are annuities a valid suggestion, an intelligent action to secure guaranteed earnings for life? Or are they an unethical consultant's means of wooling innocent clients by convincing them to relocate properties from their portfolio right into a challenging insurance policy item afflicted by too much charges? In the most basic terms, an annuity is an insurance coverage product (that only accredited agents may sell) that guarantees you month-to-month settlements.

Exactly how high is the surrender cost, and how much time does it use? This usually applies to variable annuities. The more riders you add, and the less threat you agree to take, the reduced the settlements you ought to anticipate to receive for a provided costs. After all, the insurance provider isn't doing this to take a loss (however, a little bit like a gambling enterprise, they agree to lose on some customers, as long as they even more than offset it in greater earnings on others).

What is the best way to compare Annuity Contracts plans?

Annuities picked correctly are the ideal choice for some individuals in some situations., and after that number out if any annuity choice supplies enough benefits to warrant the prices. I made use of the calculator on 5/26/2022 to see what an instant annuity could payout for a single costs of $100,000 when the insured and partner are both 60 and live in Maryland.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Everything You Need to Know About Fixed Income Annuity Vs Variable Growth Annuity Defining the Right Financial Strategy Benefits of Fixed Index Annuity Vs Varia

Breaking Down What Is Variable Annuity Vs Fixed Annuity Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Fixed Vs Variable A

Understanding Financial Strategies Everything You Need to Know About Retirement Income Fixed Vs Variable Annuity Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Ch

More

Latest Posts